How to Save You Money On Life Insurance?

Top 10 Tips for Getting the Best Life Insurance Rates

Did you catch wind of this interesting tidbit? Embracing a healthy lifestyle might just pad your wallet when it comes to insurance premiums. Yep, certain insurance providers give discounts to folks who keep the scale steady or make exercise a regular gig. So, not only do these perks lighten the load on your bank account, but they also nudge you toward a healthier, happier you. Win-win, right?

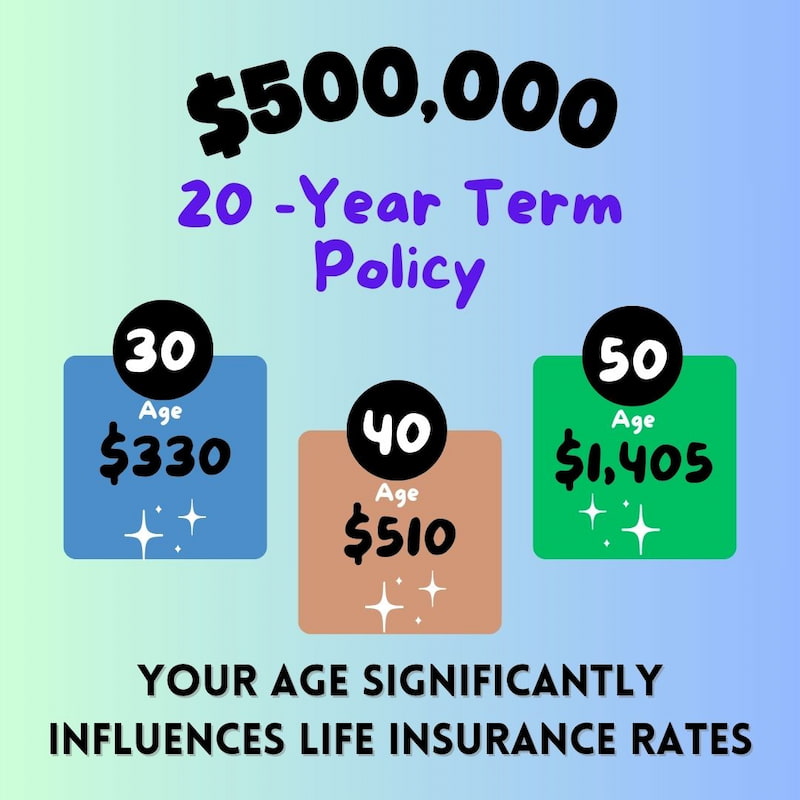

1. Buy When You Are Young

Your age significantly influences life insurance rates at the time of purchasing the policy. If you’re young, the premiums will be lower. For example, a nonsmoking man in excellent health buying a $500,000 20-year term policy.

The average annual premium would be $330 if he buys it at the age of 30, $510 if he buys it at 40, and $1,405 if he buys it at 50. Purchasing a policy at a young age can ensure that the premiums remain low throughout the term, whether for 20 or 30 years or your lifetime, with specific types of permanent insurance. As you age, you become more prone to health issues that may increase your premiums or make it challenging to become eligible for coverage.

2. Consider Term Insurance

There are several reasons why people choose to buy life insurance. One of the most common reasons is to provide financial support to their family until their children are grown or to cover mortgage payments until their home loan is paid off.

If you only need life insurance for a limited period, you can consider purchasing term life insurance. Term insurance premiums are usually lower than permanent life insurance premiums, such as whole life or universal life, for the same death benefit. You can choose to lock in your premium rate for a certain number of years, such as 20 or 30 years, with the length of the term affecting the amount of your premiums.

However, one disadvantage of term insurance is that if you need life insurance for longer than the term you initially chose, you may pay higher premiums after the term ends. On the other hand, permanent insurance never expires as long as you keep up with the required premiums, and you can also build up cash value savings, which is impossible with term insurance.

If your insurance needs change, it’s a good idea to check if you can convert your term life insurance policy to permanent life insurance. Remember that there’s usually a limited amount of time to do this without going through new medical underwriting.

Learn About Life Insurance

- How to View Life Insurance as an Investment Tool

- 6 Reasons the Average Person Always Needs Life Insurance

- How and Why to Buy a Life Insurance Policy?

- Why Everyone Should Get Life Insurance In Canada For A Better Future

3. Calculate Your Coverage Needs

Calculating the amount of life insurance you need is an essential step before you begin comparing rates. It’s important to consider how much coverage your family requires for regular bills, but you may not need to pay off the entire mortgage or cover the total cost of college for your children.

Additionally, if your children are older or your spouse is employed, you may need less coverage than someone who is the sole provider and has young dependents.

It would be best to use a life insurance calculator, such as the one available from an insurance advisor, to determine the appropriate coverage for your circumstances.

Furthermore, it is essential to review your insurance needs every few years or when significant life changes occur, such as having another child or purchasing a new home with a larger mortgage.

Life Insurance. How Much Life Insurance do I Need?

4. Shop Around

Insurance premiums can vary widely from one company to another, even for the same person. This is because some insurers have different rate classes based on your health and risk factors, while others may charge more for the healthiest people. For example, some insurers have standard, preferred, and super-preferred rates for the healthiest individuals, while others may charge higher “table rates” for people with health issues. Some companies also offer specialized products for specific conditions explicitly designed for people with diabetes.

When shopping for life insurance, it is important to provide as much medical information as possible to get accurate price quotes from several insurers. The insurer with the best rates for the healthiest people may not have the best rates for people with any medical issues. You should also ask about premium bands when shopping for life insurance, as most life insurance products have premium bands. Higher face amounts have lower premium rates, so it may cost less to buy more coverage in some cases.

For instance, suppose you want to buy a $475,000, 10-year term policy for a healthy 44-year-old male nonsmoker from a reputable company. In that case, the cost may be $439.50. However, if you opt for $500,000 of coverage, the price is similar to $440.00 because the rate drops to $500,000. Therefore, if the life insurance you need is close to the next higher band, get a quote at the higher amount.

Improve Your Health and Save Your Money!

5. Don’t Buy a Guaranteed Issue Policy If You Are Healthy

Specific insurance policies are called “guaranteed issue” policies. These policies don’t require a medical examination and can be issued quickly. However, it’s important to note that insurance providers generally assume that people applying these policies may have underlying medical issues.

If you have pre-existing medical conditions, a guaranteed-issue policy may be your only option. But if you are in good health, you should try to get a traditional policy that requires a medical examination. A policy with medical underwriting will give you lower rates than a guaranteed policy.

Kick the Habit, Save Big: Quit Smoking, Save on Insurance!

6. Quit Smoking And Save Your Money On Insurance

It is essential to understand that smoking can significantly reduce your life expectancy and increase the risk of the insurer paying a death benefit. As a result, smokers have to pay higher life insurance rates than nonsmokers, usually two or three times higher. During your medical exam, the insurers generally check for evidence of nicotine in your bloodstream. The definition of smoker and its impact on rates can vary by insurer, so it’s a good idea to get quotes from several insurers.

If you quit smoking, you may be eligible for a lower rate, but you usually need to stop for more than a year to be considered a nonsmoker. The period and price difference after you quit can also vary by insurer. To learn more about how smoking affects life insurance rates, visit your preferred insurer’s website.

7. Lose Weight And Improve Your Health

Your body mass index (BMI), determined by height and weight, can significantly impact your insurance premiums, particularly for the best-rate classes. The Centers for Disease Control and Prevention recommends calculating your BMI by dividing your weight in kilograms by the square of your height in meters.

Your BMI, cholesterol, and blood pressure readings can also affect your rate, particularly in the best-rate classes. Each insurance company sets its specific cut-offs for these factors.

Taking medication to control high blood pressure or cholesterol may make you eligible for a lower rate. Insurers may also consider how these factors interact.

8. Present a Strong Case If You Have Medical Issues

In the past, insurance companies automatically rejected people with certain medical conditions. However, with the advancement in medical technologies and research by insurers, some of these conditions may now be insurable. Insurers now request more details about the condition before deciding whether to issue the policy and determine the premium rate. It’s important to note that different insurers may have different criteria, so shopping around is crucial if you have pre-existing medical conditions. Check out more information on buying life insurance with pre-existing conditions.

9. Ask For a Rate Re-evaluation If Your Health Improves

If your health improves, you may want to consider asking your insurance company for a rate re-evaluation. This can help you save money on your insurance policy. However, you will need to submit new medical records to your insurer. Additionally, a certain amount of time may need to pass after your health has improved for your new situation to be considered.

If your insurance company is unwilling to adjust your rates, you may want to shop around for a policy from another insurer. Another insurance company may offer you a better deal based on your health status.

10. Ask About Discounts And Rewards Programs

Some insurance companies offer discounts to policyholders who pay their premiums automatically via their credit card or bank account and to those who pay their bills for the entire year in a lump sum rather than having monthly or quarterly billing. Another way of saving money on life insurance premiums is through rewards-based premium discount programs for healthy lifestyles, which are relatively new offerings by insurance companies. One such program is the Manulife Vitality program, launched in 2015.

The Manulife Vitality program has two levels. The first level is Vitality GO, which is free of charge and offers discounts on health-related products and services, including healthy food. The second level is Vitality PLUS, which is a comprehensive lifestyle program that Vitality program rewards healthy steps individuals take daily, such as exercising, getting annual health screenings, staying tobacco-free, purchasing healthy food, and practicing meditation and good sleep habits. This enables customers to earn potential premium savings of up to 25%, along with discounts, benefits, or rewards from popular retailers.

Policyholders achieve a Bronze, Silver, Gold, or Platinum Vitality Status and receive premium discounts depending on their level. These life insurance rewards programs have helped customers save money and have shown results in improving health. Tingle says that six years of the program have demonstrated that Vitality helps members maintain or improve their health. For example, 76% of members improved or maintained a healthy weight, 50% reported reductions in BMI, and 37% with high cholesterol brought their measures into range within a year. Additionally, nearly 41% of members with high blood pressure reported bringing their reading into range over a year, and 43% of members with high glucose levels brought their levels into range over a year.

Life insurance is essential to your financial plan, but it doesn’t have to be costly. By following these tips, you may be able to find an affordable life insurance policy that meets all of your needs.

Want to save big on life insurance? Start living healthier and follow these tips to lower your premiums! Contact us now to find out how.

Contact Glenn today at 1-888-256-8685 to learn more about your life insurance options in Kitchener and Waterloo?