The Benefits of Mortgage Insurance. Know what You Don’t Know

Mortgage Insurance Protects You not the Bank

What is the Difference Between Mortgage Life Insurance and Mortgage Default Insurance?

Mortgage Life Insurance and Mortgage Default Insurance sound like similar products. They are easy to confuse. Mortgage default insurance may be required without a 20% down payment, while Life Insurance is optional. Refer to the chart below to compare the two and see if Mortgage Life Insurance is worth it for you.

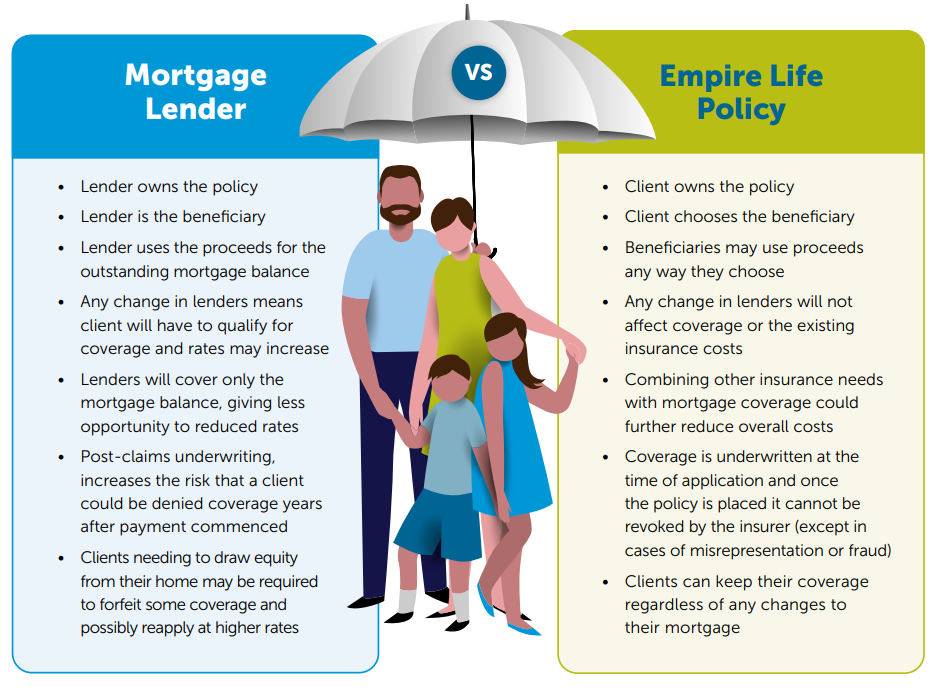

Does your current mortgage insurance protection option provide what you need?

Buying a new home or renewing your mortgage? Many Canadians quickly add mortgage protection insurance without reading the fine print. Did you know that term life insurance and health insurance could save you thousands, give you more flexibility and provide better coverage?

Let us help you take control of your protection plan:

- You decide who gets the death benefit by choosing a beneficiary

- Leave your beneficiaries with the flexibility to use the payout in any way they wish

- Protect your loved ones in case of death

- Protect yourself and your loved ones from the impacts of critical illness

- Keep your coverage even as you pay off your mortgage

- Keep your coverage even if you move homes or change lenders

What is Mortgage Protection Life Insurance?

- Mortgage Life Insurance, also known as Mortgage Protection Insurance, is a policy that pays off a mortgage in the event of the death of the borrower. The terms are used interchangeably in this article.

- It is a product offered by many life insurance companies and banks. It is essentially a Term Life Insurance that equals the mortgage’s length. Under a typical term life insurance policy, you may choose your beneficiary. Mortgage Life Insurance policies are a little different. The beneficiary is always the lender, who will be paid the remaining balance of your mortgage.

- That means your family only benefits indirectly. Rather than money, this policy leaves them a paid-off home and place to live.

- Imagine you owe $150,000 on your mortgage when you pass away, the mortgage protection insurance policy will pay off the balance. The policy will pay off that remaining mortgage. The home will now be mortgage-free, but your family will have no say in how that money is spent (the insurer pays it directly to the lender).

- One of the downsides of mortgage life insurance is that it provides a declining payout. As time goes by, you chip away at the balance of your mortgage through monthly payments. These decrease the potential payout. With mortgage insurance, your overall coverage decreases, but your premiums do not necessarily follow. Some providers now offer “level death benefit” so the payout remains the same, even when the mortgage debt dips below the value of the coverage amount.

Let Us Tell You About the Benefits of Buying Mortgage Insurance with an Insurance Company

As we all know, buying a home is one of the most important transactions you will ever make. You’ve found your dream home and have bought Home Insurance to cover your property and legal liability. So now, all you have left to do is unpack your boxes and settle in. Not so fast! Learn about Mortgage Insurance first.

We’re here to help you make smart decisions about your home.

Getting Insurance for Your Mortgage

What would happen if your spouse were to pass away suddenly? Would you be able to cover your mortgage payments and your expenses? Mortgage Insurance enables you to pay back all or a portion of your financial obligations in the event of death. Avoid a disability or serious illness having a huge impact on your finances and lifestyle by enhancing your coverage. This will ensure your investment is protected against life’s little surprises. Thus, you can focus on your family without worrying about money.

The Benefits of Mortgage Insurance

These days, you can buy Mortgage Insurance from a bank when signing your mortgage or you can buy it from a financial institution. To help you decide, here are the advantages of buying your Mortgage Insurance from a financial institution:

1. You Own the Contract and Choose Your Beneficiaries

When you buy Mortgage Insurance from your bank, the bank owns the contract and is the beneficiary. If you buy your mortgage insurance from an insurance company, you own the contract and can name any beneficiary you want. Your beneficiary can choose to repay the loan, pay his or her debts or use the benefit for something else. Also, if you change Mortgagers, you still have mortgage insurance.

The Benefits of Mortgage Insurance – You Own the Contract

2. Your Premium is Fixed and Guaranteed

The amount of mortgage insurance coverage you buy from an insurance company will remain the same for the duration of the loan… For example, you have a $200,000 mortgage and buy $200,000 in coverage that you will keep year after year. At a bank, the amount of your mortgage insurance coverage will decrease as the balance of your mortgage decreases while your premium will remain the same.

3. You Can Convert Your Mortgage Insurance

An insurance company will allow you to convert your Mortgage Insurance to Permanent Life Insurance, as needed, throughout the term of your loan. If you do convert your insurance, your premium may increase because now have a different type of policy and you will not have to undergo a medical exam. The policy will remain in force until your death.

4. No More Shopping Around

By buying your mortgage insurance from an insurance company, you won’t have to shop around for mortgage insurance for the duration of the term. Additionally, the cost will not increase over the years. If you buy from a bank, you are required to negotiate new mortgage insurance and your premium will be higher based on your age and any health changes.

You deserve the most mortgage protection options for you and your family

Mortgage Insurance Services available in Kitchener, Waterloo, Guelph, Milton, Mississauga, Toronto, Elora, Elmira, Listowel, Mitchell, Stratford, New Hamburg, Brantford, Hamilton, Burlington, Fergus, Oakville, and Cambridge area.

For more information about Mortgage Insurance

Call Glenn Stewart, Life and Mortgage Insurance Broker now

at 1-888-256-8685

or email glenn@glennstewartinsurance.com