Contact Us About Your Life and Health Insurance in Kitchener Now

Contact Glenn Stewart for Your Insurance Questions

Call Glenn Stewart Insurance Broker Now

Life Insurance, Health Insurance, Travel Insurance available in Kitchener, Waterloo, Guelph, Milton, Mississauga, Toronto, Elora, Elmira, Listowel, Mitchell, Stratford, New Hamburg, Brantford, Hamilton, Burlington, Fergus, Oakville, and Cambridge area.

Phone: +1519-896-9970

Toll Free: 1-888-256-8685

Address: 50 Ottawa St S. suite 147 Kitchener Ontario N2G 3S7 CA

Email: glenn@glennstewartinsurance.com

Website: www.glennstewartinsurance.com

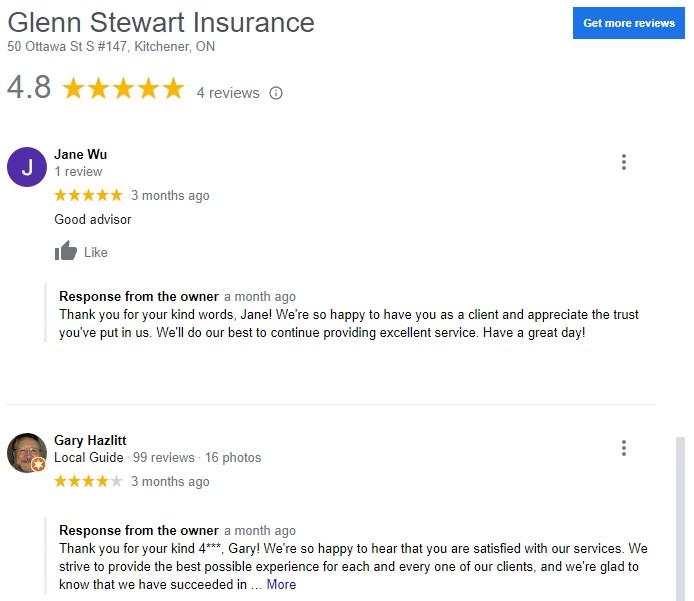

Click Here to Leave a Google Review

Send Us a Message

Error: Contact form not found.

About Insurance. Is Health Insurance in Canada Worth It?

Health insurance is a complex and often confusing topic, especially when it comes to figuring out what kinds of coverage are available in different countries. In Canada, there are a variety of options available for health insurance, but it can be difficult to know whether or not the coverage is worth the price. Take a look at the different types of health insurance available in Canada and try to answer the question: is health insurance in Canada worth it?

The first thing to understand about health insurance in Canada is that there is no one-size-fits-all solution. The type of coverage you need will depend on your individual circumstances and needs. For example, if you are a student, you may be able to get by with a basic plan that covers emergency medical care. On the other hand, if you have a family, you’ll likely need a more comprehensive plan that provides coverage for things like prescription drugs and routine doctor’s visits.

How to choose the Right Life Insurance Advisor in Canada

It’s important to choose the right life insurance advisor in Ontario if you want to get the best coverage. There are several ways of finding the right agent, and you need to be careful enough to choose one. Remember that hiring professionals with experience is always a better choice since they would be able to help guide you in the right direction.

If you are looking for life insurance advice in Kitchener, Waterloo, Cambridge or Guelph, there are several online resources and professional organizations that can provide assistance. It’s important to research the advisor carefully before making a decision. Look at their educational background, customers review, Google Business Profile, experience and qualifications, as well as their industry membership status and awards won. Ask about their recommendations on various types of insurance.

It is a good idea to go through social media for reviews about Glenn Stewart Insurance. This can help you get an idea of how others have experienced their services and whether or not they recommend them. Additionally, it is important to ask around for other people’s opinions about the company and to read through any terms and conditions that may be attached to their policies before making a purchase. Taking these steps will ensure that you are making an informed decision and will be happy with the results.

Finally, it is also a good idea to contact Glenn Stewart Insurance directly so that you can ask any questions or concerns you may have before making a purchase.

About Insurance Broker

- The Benefits of Having an Insurance Broker

- An Experienced Advocate

- A Wide Network of Providers

- Better Coverage at a Lower Cost

- Glenn Stewart Wealth & Life Insurance Specialist

Call Glenn Stewart Insurance Broker in Kitchener – Waterloo area Now

at +1519-896-9970

Life Insurance Broker available in Kitchener, Waterloo, Guelph, Milton, Mississauga, Toronto, Elora, Elmira, Listowel, Mitchell, Stratford, New Hamburg, Brantford, Hamilton, Burlington, Fergus, Oakville, and Cambridge area.